The price of gold tends to increase due to a combination of economic, geopolitical, and market factors. Here’s why gold prices might be rising:

1. Economic Uncertainty

- Inflation: When inflation rises, the purchasing power of currencies declines, making gold a more attractive store of value.

- Recession Fears: During economic downturns, investors often seek the relative safety of gold, driving up demand.

2. Geopolitical Tensions

- Gold is a safe-haven asset. Political instability, wars, or global conflicts can lead to increased demand for gold as investors look for a secure asset to protect their wealth.

3. Central Bank Policies

- Lower Interest Rates: Central banks lowering interest rates makes bonds and savings accounts less attractive, pushing investors toward gold.

- Monetary Easing: Large-scale money printing (quantitative easing) by central banks can devalue currencies, increasing gold’s appeal.

4. Currency Fluctuations

- A weaker U.S. dollar makes gold cheaper for holders of other currencies, leading to higher demand.

- Conversely, a strong dollar can pressure gold prices down.

5. Supply and Demand Dynamics

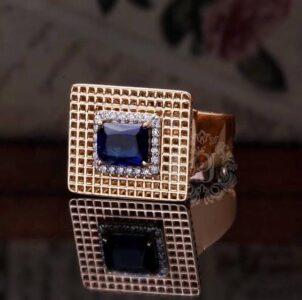

- Limited mining output and growing demand, especially from countries like China and India for jewelry and investment, can increase prices.

6. Market Sentiment

- Speculation and market sentiment can lead to sudden changes in gold prices, especially during times of global financial uncertainty.

7. ETF and Institutional Demand

- Gold-backed exchange-traded funds (ETFs) and large institutional purchases can drive up prices.

Gold prices are influenced by a combination of these factors, and the recent increase could be due to a mix of economic uncertainty, geopolitical tensions, and central bank actions. If you’d like, I can look up recent trends to provide more specific details.